Archive for February 2022

Stitch raises $21m to build the future of Africa’s fintech

South Africa’s API fintech Stitch has raised $21 million in a Series A round led by New York’s Spruce House Partnership.

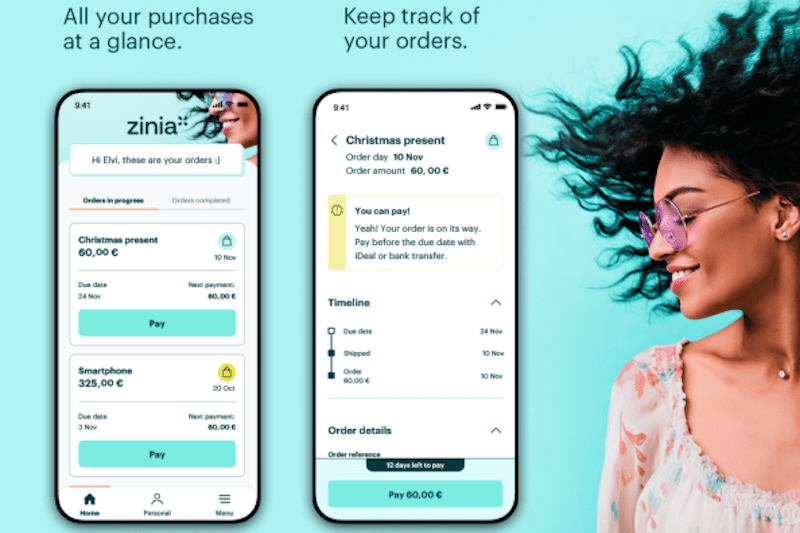

Read MoreSantander enters Buy Now Pay Later space with its new Zinia platform

Spanish bank Santander is launching its own Buy Now Pay Later (BNPL) service in Europe with the roll-out of Zinia, a new consumer financing platform that allows shoppers to split their purchases over monthly interest-free instalments in online and physical stores. The app will initially be made available in the Netherlands and will give Zinia…

Read MoreITV Win players to benefit from Open Banking with Ecospend’s ‘pay-by-bank’ service

ITV partners with Ecospend to enable customers to pay by bank when taking part in ITV Win competitions.

Read MoreEquitable announces agreement to acquire Concentra Bank for total purchase price of $470m

Equitable Bank has entered into a definitive agreement to acquire a majority interest in Concentra, the 13th largest Schedule I bank in Canada.

Read MoreNetwork B turns to Nordigen for financial data to power client loyalty programmes

Network B plugs into Nordigen’s free Open Banking platform for raw transactional data as an alternative to card linking.

Read MoreNovibet partners with Citizen to make gaming transactions safer and faster

Novibet has teamed up with Citizen to make gaming transactions safer, faster and effortless by guaranteeing instant account-to-account (A2A) deposits and withdrawals, and simple payment journeys.

Read MoreTink and Youtility partner to offer embedded subscription and carbon management tools

Tink and Youtility have entered a strategic partnership to provide UK retail banks with embedded subscription and money management tools.

Read MoreGoCardless secures $312m to accelerate growth in open banking

GoCardless has secured $312 million in a Series G funding round, making it the latest European and UK tech unicorn valued at $2.1 billion.

Read MoreBoston Fed and MIT publish initial CBDC design research findings

The work produced one code base capable of handling 1.7 million transactions per second.

Read MoreSME online retailers can save £19,000 a month on transaction fees – Yolt

Open Banking technology can help small and medium-sized online retailers save an estimated £19,000 by reducing transaction fees associated with payments providers.

Read More