Archive for April 2023

Female fintech leaders call for ‘more reporting’ to close gender pay gap

Joint research by EY and Innovate Finance has found women in fintech face a pay gap of 22%.

Read MoreQ&A: Mainstreet CU’s Jamie Kruspel on the ‘critical piece’ of Canada’s Open Banking puzzle

Jamie Kruspel, who is speaking at Open Banking Expo Canada, reveals which providers are likely to benefit the most from the successful delivery of Open Banking in Canada.

Read MoreRafa Plantier exits Nubank for telecoms-as-a-service platform Gigs

Gigs has appointed Rafa Plantier as head of financial services to help “drive the convergence of banking and telecommunications at scale”.

Read MoreFinastra: Global banks partnering with fintechs to reduce operational costs

Three in four global banks intend to connect with an average of three fintechs in the next 12 to 18 months, research by Finastra found.

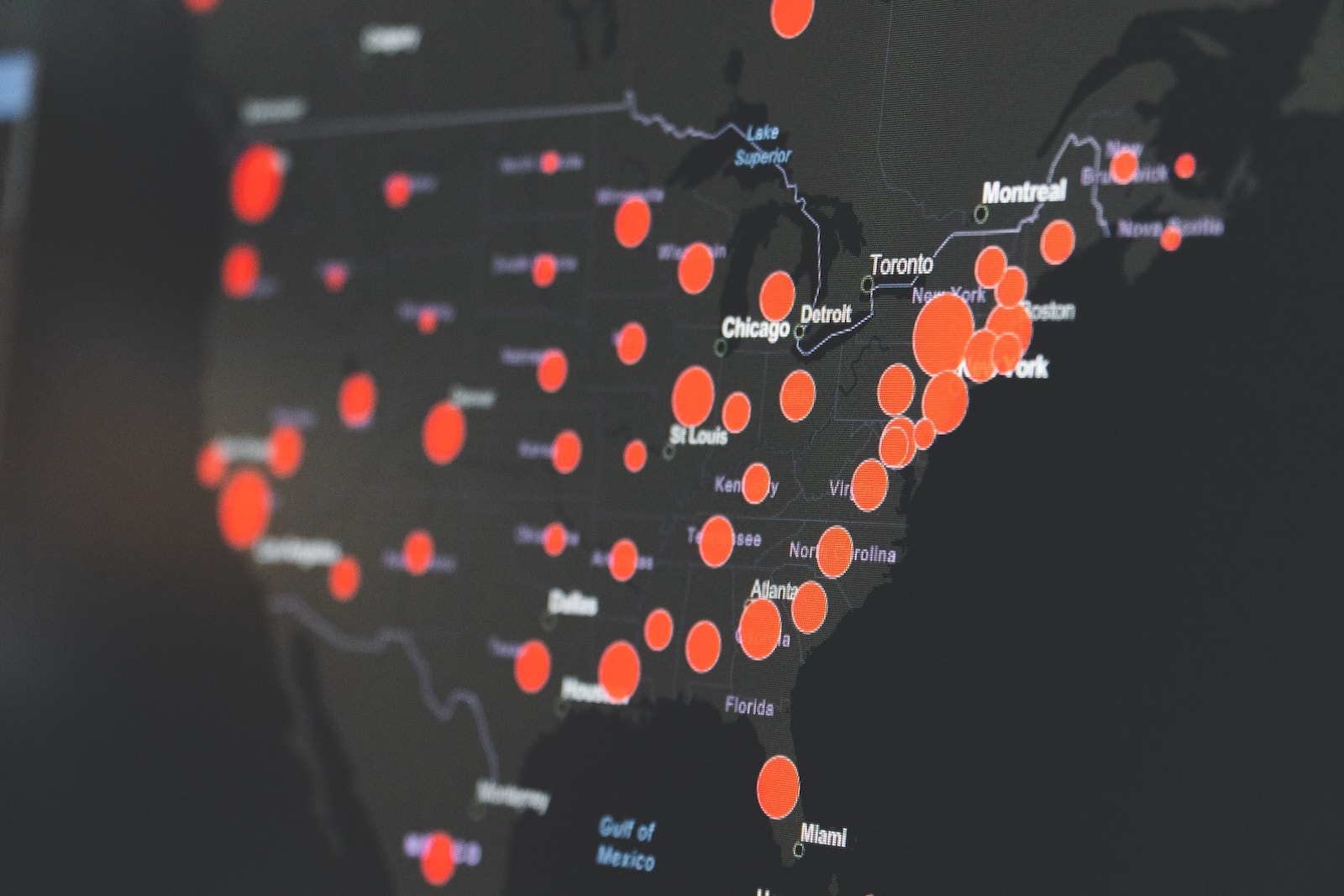

Read MoreAirwallex rolls out global payments to Canada

Some of Airwallex’s key offerings, such as local currency accounts in more than 12 currencies, will initially be available to Canadian businesses.

Read MoreInsight: Why ‘headless banking’ is banks’ secret to winning customers back from fintechs

Jim Gillespie of Dragonfly Financial Technologies explains how ‘headless banking’ can help create a level playing field for banks and fintechs.

Read MoreAustralia’s BCU Bank teams up with Frollo to launch financial empowerment app

Frollo’s chief executive officer said that “Open Banking is the key to providing customers with a comprehensive view of their finances”.

Read MoreLindsay Hodges joins BankiFi in the US to lead product management

BankiFi, which launched in the US in 2022, has appointed Hodges as it continues to grow its North America presence and offering.

Read MoreEcospend hires Lord Chris Holmes after facilitating £13bn in tax payments to HMRC

Lord Holmes, an advocate of technology and social mobility, will advise Ecospend as Open Banking payments use cases grow.

Read MoreLloyds Bank unveils ‘PayMe’ service for businesses

The new payment transfer offering means companies can send funds “within minutes”, without the need for capture and store account details.

Read More