Posts by Newsdesk

Boost Capital looks to Open Banking to power small business finance

Boost Capital, a leading provider of small business financing, today announced the launch of Open Banking capabilities as part of the company’s efforts to accelerate the funding process and improve the customer experience for small and medium-sized enterprises (SMEs) applying for financing. Open Banking enables businesses to share their financial information with providers in real-time.…

Read MoreSbanken chooses Nets to support Open Banking

Norwegian bank Sbanken has selected Nets to support open banking with Nets Access to Account Services (NAAS) – a single platform that enables access to banks across the Nordics and Europe. The revised Payment Services Directive (PSD2) will facilitate new services and better overviews of finances for bank customers. Nets’ single integration solution will give…

Read MoreIndustry blog: Is your bank ready for the first major PSD2 deadline?

One more day remains until the next PSD2 milestone. Tomorrow, the EU banks should make available a sandbox to third party providers for connection and functional testing of their applications and how they interoperate with the bank interface.

Read MoreWells Fargo Accelerator announces new members

Ascent RegTech and Motiv have joined the Wells Fargo Start-up Accelerator programme, giving them each access to funding of US $1 million. Designed to help advance emerging technologies in the financial services industry, start-ups joining the scheme are each eligible for up to $1 million in funding to help refine their ideas, along with guidance…

Read MoreGlobal spotlight: a view from the U.S

Open Banking may be all the rage in the UK, but in the U.S. it’s not quite ready for prime time. “It’s a hot topic for all banks right now,” affirmed Richard Muskus Jr., president of Stamford’s Patriot Bank. “It’s all about how we can better compete with larger, more sophisticated tech platforms, the fintechs,…

Read MoreRaisin confirms acquisition of German banking provider MHB Bank

The surge in innovation sees no sign of letting up and this acquisition is no different. Hot on the heels of raising $114 million in Series D funding, Raisin, the pan-European fintech marketplace for savings and investment products, has acquired MHB Bank of Frankfurt, its main provider of banking services in Germany. Terms of the…

Read MoreBlog: 99% of financial firms expect to benefit from Open Banking

A near-unanimous 99% of financial services organisations polled expect Open Banking to benefit their business. Over half (52%) believe that Open Banking will speed up their application or onboarding process, whilst 46% expect it to improve customer experience, according a recent white paper by TransUnion. Research conducted by Forrester Consulting* on behalf of TransUnion showed…

Read MoreNew Zealand edges closer to Open Banking

Banks in New Zealand will need to loosen their grip on customers’ private data as the region edges toward Open Banking. At the moment customers breach their bank’s terms and conditions if they allow any third party access to their accounts. Payments NZ – which governs New Zealand’s payment systems on behalf of the banks…

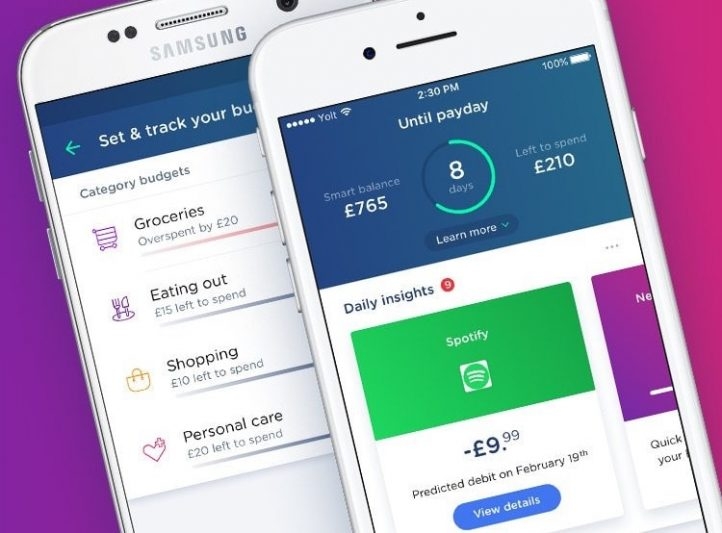

Read MoreYolt begins beta tests for payment initiation service

Source: Yolt Taking the next step in the Open Banking journey, Yolt moves into testing Payment Initiation Services (PIS) with their UK community and the launch of ‘Yolt Pay Beta’. This latest feature will enable users to initiate payments to friends and family as well as move money between their own accounts via the app.…

Read MoreTully receives FCA license to help improve financial capability of consumers

For the first time since its inception, the FCA has issued a license for the provision of a digital debt advice solution. Tully is a fintech start-up created to improve financial capability, make it easier for people to manage their money and repay their debts faster. The timing of the license couldn’t be more…

Read More