Industry news

The lender has named Björn Kombächer as country head for Germany and has said Germany could be its “biggest market”.

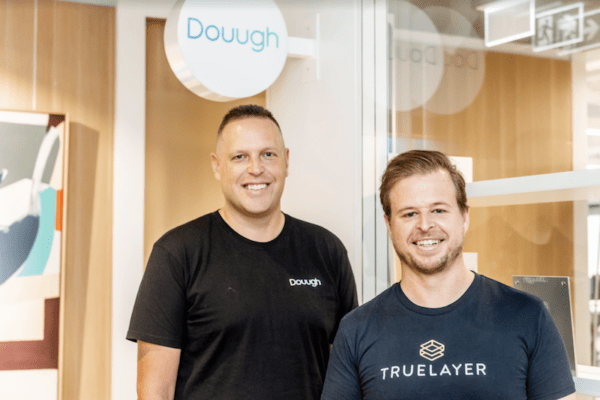

Banking app Douugh will become a CDR representative of TrueLayer in Australia.

James Pomeroy, global economist at HSBC, reveals his thoughts on Sweden’s Riksbank and explains what is the biggest hurdle when it comes to CBDCs entering the mainstream.

TransUnion’s senior director of Open Banking in the UK, Nino Ocampo, writes about how lenders can use Open Banking to help consumers better navigate their post-pandemic finances

The An Post ‘Money Manager’ app, launched last year, will use Tink’s Open Banking technology to help customers improve their “financial confidence”.

The payments platform has bought Open-Banking enabled cashback app Upside to begin integrating Open Banking into its services.

Jim Ford, payments consultant at Digital Pound Foundation, reveals what needs to happen for CBDCs to become part of mainstream finance.

Roland Selmer, chief product officer at Yapily, writes about why it’s time to change the narrative when it comes to measuring the success of Open Banking in the UK.

Aman Cheema, senior vice president and general manager, global real-time payments at FIS considers whether CBDCs will change the balance of power of global reserve currencies, and explains the work FIS is doing on CBDCs.

Obconnect CEO Darran Morford said on LinkedIn that the Confirmation of Payee market is set to expand in 2022.