Insights

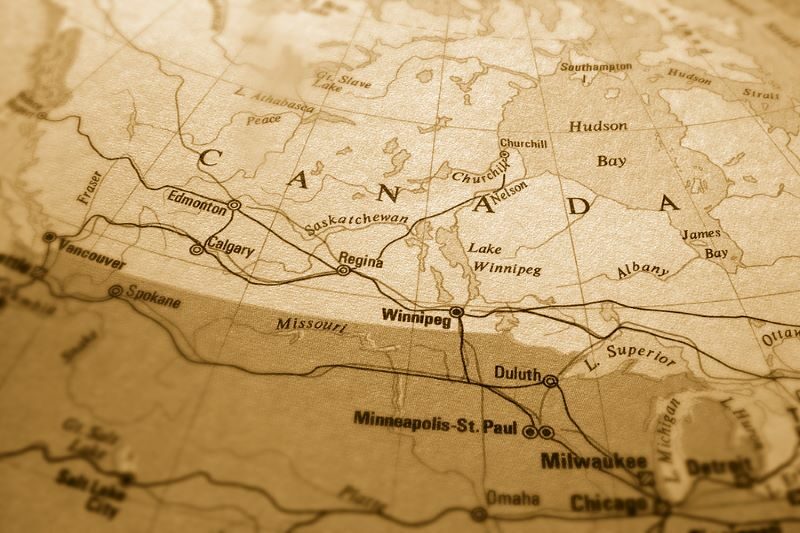

Q&A: Axway’s Eyal Sivan on why Canada needs ‘practical steps’ and ‘not just talk’

Eyal Sivan, head of Open Banking at Axway, explains why ‘strong leadership’ is only part of the way to get Open Banking over the line in Canada, and what it can learn from Brazil’s implementation journey.

Read MoreInsight: How fintech is facilitating the future world of work

A new report finds a third of businesses are crying out for freelancers – but can’t pay them on time. Sonovate’s Richard Prime explains which fintech trends are helping businesses to accommodate the rising freelance demographic.

Read MoreQ&A: Symcor’s Saba Shariff on getting Open Banking in Canada over the line

Saba Shariff, head of new product development and corporate strategy at Symcor, tells Open Banking Expo what needs to happen in the next six months to move consumer-directed finance forward in Canada.

Read MoreQ&A: Creditspring’s Neil Kadagathur on demystifying credit scores

Open Banking Expo’s Ellie Duncan caught up with Neil Kadagathur, co-founder and CEO of Creditspring, to find out how the firm is meeting the needs of historically underserved near-prime borrowers and why credit scores are his ‘bugbear’.

Read MoreInsight: How small businesses can ride the virtual cards revolution

Tradeshift Go’s Mason Burr writes about why small businesses might want to make the move from plastic to virtual cards.

Read MoreBlog: What happened at Open Banking Expo UK?

As the Open Banking ecosystem reunited at Open Banking Expo UK in London yesterday (4 November), discussions centred around partnerships, payments and potential, as Ellie Duncan reports.

Read MoreInsight: Why VRPs have the potential to be transformative

Volt CEO Tom Greenwood explains why variable recurring payments are the most significant development in Open Banking to date.

Read MoreQ&A: Mambu’s Eelco-Jan Boonstra on communicating the value of Open Banking

Open Banking Expo’s Ellie Duncan caught up with Eelco-Jan Boonstra, managing director of EMEA at Mambu, to discuss how banks and fintechs can better communicate the value of Open Banking to end consumers and how the industry stepped up during the pandemic to meet SMEs’ needs.

Read MoreQ&A: Token’s Todd Clyde on his open payments predictions

Open Banking Expo’s Ellie Duncan caught up with Todd Clyde, CEO of Token, ahead of this year’s Open Banking Expo UK event in London, which takes place on 4 November, with Token as the headline partner.

Read MoreInsight: Fintech’s vital role in bolstering SMEs’ recovery

Tomato pay CEO Nicholas Heller writes about the power of fintechs to support small businesses and sole traders as they emerge from the pandemic.

Read More