Latest news

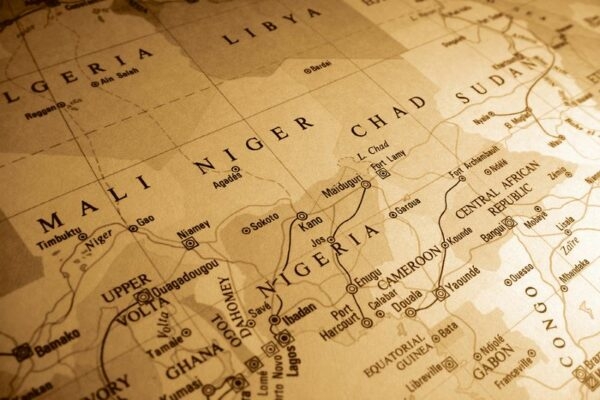

Africa’s domestic e-payments market is forecast to swell to $40 billion by 2025.

The expansion of Token’s Open Banking coverage network means it now includes more than 80% of bank accounts in Italy.

The program will provide Black-led businesses with dedicated support and financing, addressing the “obstacles” Black entrepreneurs typically face.

The implementation of new digital payment infrastructure and services is the first stage of a new Financial Infrastructure Transformation Programme.

New data from Experian also showed a “striking” rise in first-party fraud in the UK.

CMS has become the first business to adopt the new feature by NatWest’s Payit to enable digital collection of charitable donations.

The financially-inclusive digital payments solution enables on-demand cashouts into mobile wallets.

The fintech’s new London office marks its physical site outside the US, as it eyes further global expansion.