Latest news

The program will provide Black-led businesses with dedicated support and financing, addressing the “obstacles” Black entrepreneurs typically face.

The implementation of new digital payment infrastructure and services is the first stage of a new Financial Infrastructure Transformation Programme.

New data from Experian also showed a “striking” rise in first-party fraud in the UK.

CMS has become the first business to adopt the new feature by NatWest’s Payit to enable digital collection of charitable donations.

The financially-inclusive digital payments solution enables on-demand cashouts into mobile wallets.

The fintech’s new London office marks its physical site outside the US, as it eyes further global expansion.

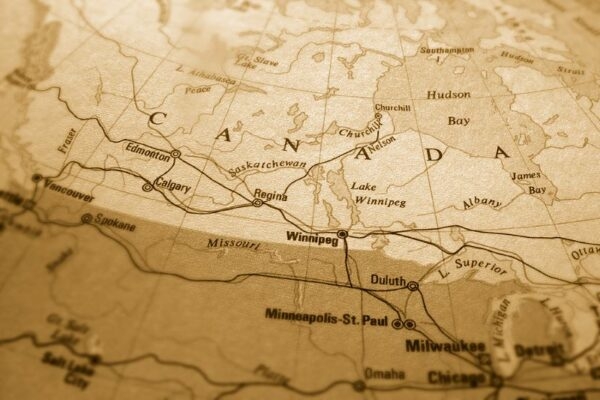

Research by Mastercard Canada found that the majority of small business owners already use digital financial tools, with security a high priority.

The Nordic fintech will use the capital injection to offer new digital banking solutions to customers.