Latest news

The central bank will work with the MIT Media Lab’s Digital Currency Initiative to explore a potential CBDC.

The new partnership will enable Anglian Water to process customer payments using Open Banking technology.

Abhishek Sinha, EY Canada partner, on how FIs can capitalize on retail and SMB clients’ willingness to share data to maximise their Open Banking “potential”.

Theresa Casey has been hired, marking the last of the additions to OBIE’s senior leadership team.

Tink’s Tom Pope says Europe is at a “tipping point for the mass adoption of Open Banking payments”.

Selene Brett will join Yapily’s executive team from OBIE, where she was general counsel.

Experian’s Mohammed Chaudhri and Natalie Hammond join Open Banking Expo TV to discuss the role that advanced analytics and data will play.

in3 has also partnered with Worldline to offer free BNPL services, starting in the Netherlands.

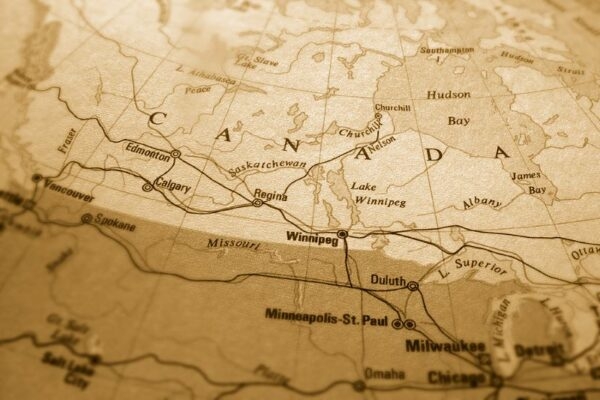

Nick Chandi, co-founder and CEO of ForwardAI, explains why Canada needs to move on from screen-scraping if it is to implement Open Banking by 2023.