Latest news

The Indonesian banking and digital finance platform will use the investment to help fund its expansion in Southeast Asia.

Yapily’s first listing on the digital catalogue will expand its cloud offering.

The latest data from the OBIE revealed that active users in the UK went from 4 million to 5 million in only four months.

The bank has partnered with Bankifi for the launch of the Revenu app, which aims to help TSB’s small business customers collect payments.

He joined Nucoro, a wealthtech platform, in January this year in the role of chief revenue officer, having left Yapily in April 2021.

Salt Edge’s solution will enable ConnectPay to offer Open Banking payments in Germany and the Netherlands.

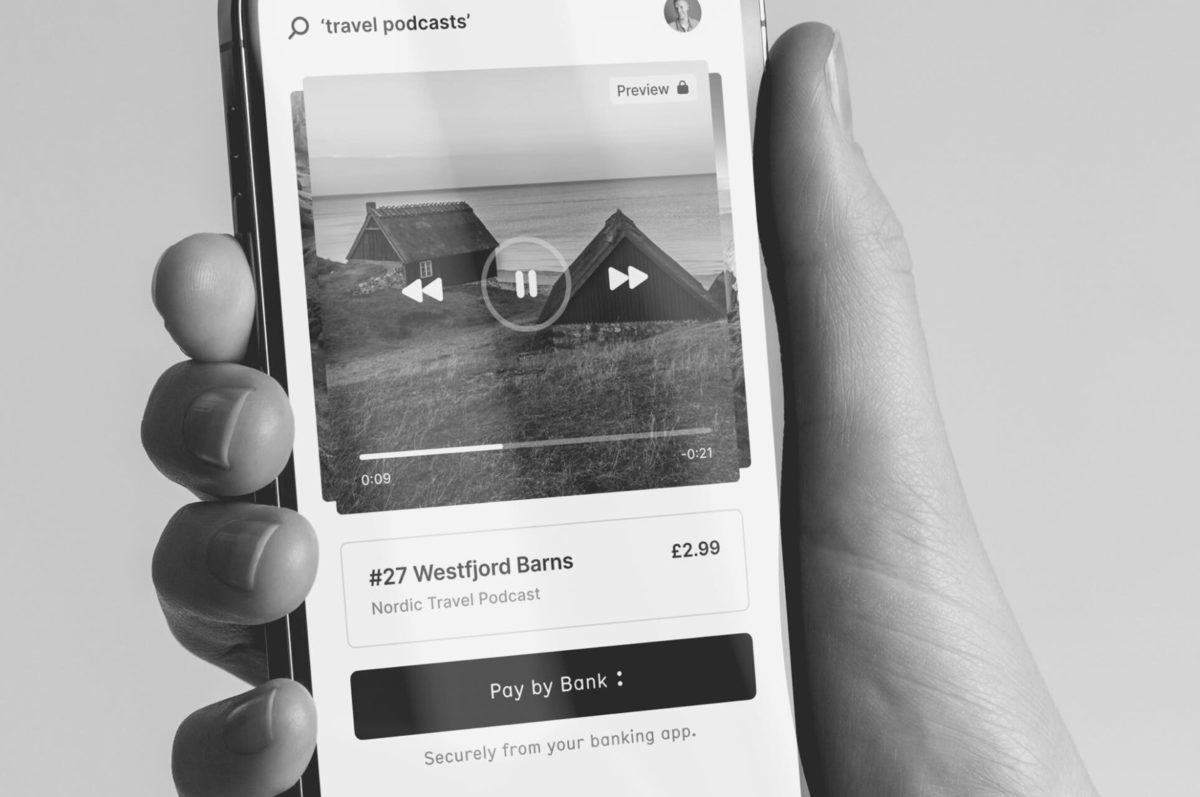

Banked has announced the completion of a $20 million Series A funding round led by Bank of America and Edenred Capital Partners.

South Africa’s API fintech Stitch has raised $21 million in a Series A round led by New York’s Spruce House Partnership.

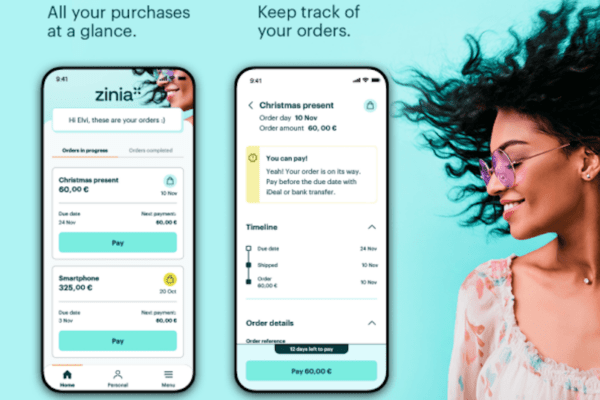

Spanish bank Santander is launching its own Buy Now Pay Later (BNPL) service in Europe with the roll-out of Zinia, a new consumer financing platform that allows shoppers to split their purchases over monthly interest-free instalments in online and physical stores. The app will initially be made available in the…